2025 Mileage Reimbursement Rate Calculator Usa. How to accurately track mileage for. Mileagewise’s mileage reimbursement calculator is an online tool tailored to assist both companies and employees in accurately calculating the mileage.

The standard business mileage rate increases by 1.5 cents to 67 cents per mile. Find current rates in the continental united states, or conus rates, by searching below with city and state.

Irs Per Diem Rates 2025 Mileage Dory Nanice, Mileagewise’s mileage reimbursement calculator is an online tool tailored to assist both companies and employees in accurately calculating the mileage. Use the current irs standard mileage rate or a rate set by.

New Mileage Rate Method Announced Generate Accounting, 17 rows page last reviewed or updated: New standard mileage rates are:

2025 Mileage Form Printable Forms Free Online, For the 2025 tax year (taxes filed in 2025), the irs standard mileage rates are: Our free online irs mileage calculator makes calculating mileage for reimbursement easy.

how to calculate mileage claim in malaysia Boris Coleman, The 2025 irs mileage rates have been set at 67 cents per mile to accommodate the economic changes over the past year. The standard business mileage rate increases by 1.5 cents to 67 cents per mile.

2025 & 2025 Mileage Reimbursement Calculator Internal Revenue Code, Mileage rates for travel are now set for 2025. Calculating your car allowance or mileage rate for 2025.

IRS Mileage Reimbursement Rate 2025 Recent Increment Explained, The rate is increased to 67 cents per mile, up by 1.5 cents from the. Back to business math calculators.

2025 Federal Mileage Rate Rules, Calculation and Reimbursement, Our free online irs mileage calculator makes calculating mileage for reimbursement easy. 14 cents per mile for charity.

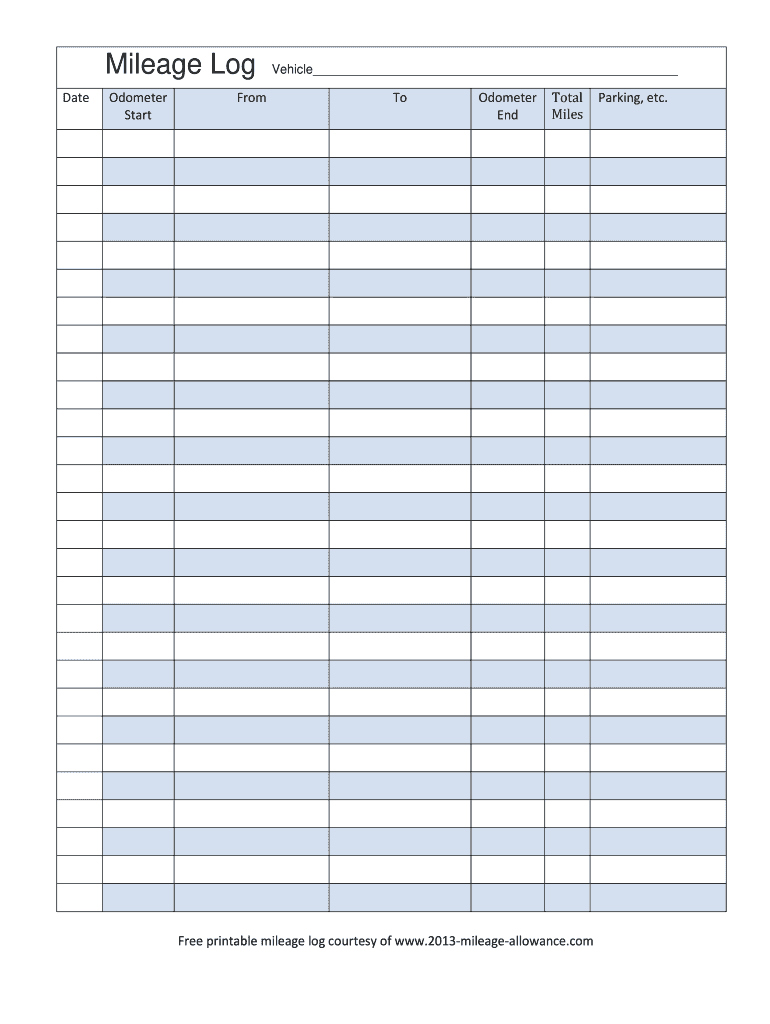

2025 Mileage Log Fillable, Printable Pdf & Forms Handypdf Throughout, For the 2025 tax year (taxes filed in 2025), the irs standard mileage rates are: Our 2025 mileage deduction calculator uses standard irs mileage rates to calculate your mileage deduction for taxes or reimbursement.

New Mileage Rate Calculator to Budget for Reimbursement Costs, The medical and moving mileage rates are now 21. Calculating your car allowance or mileage rate for 2025.

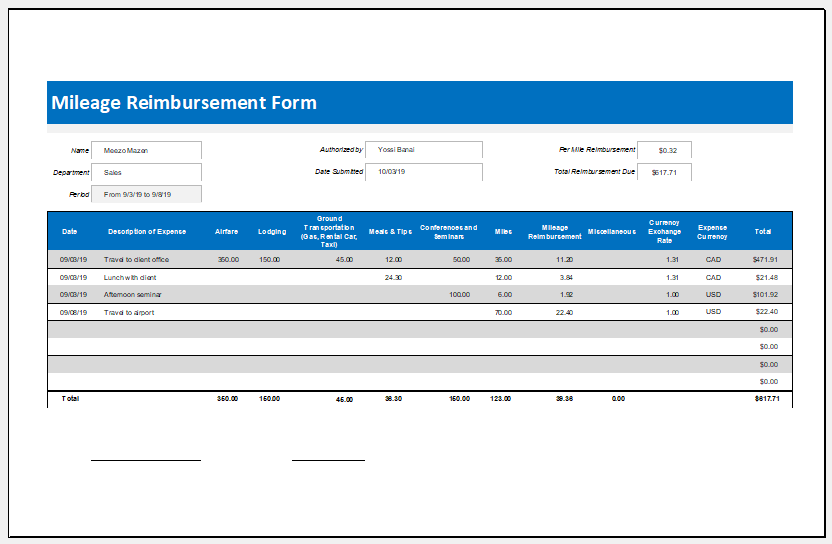

Free Mileage Reimbursement Form 2025 IRS Rates PDF Word eForms, Determine the applicable mileage rate: Select the tax year you want to calculate for and enter the miles driven to see how much money you can get.

The new rate is set at 65.5 cents per mile, an adjustment from the previous year’s rate, reflecting changes in operational costs, such as fuel prices and vehicle.